how much is virginia inheritance tax

Select Popular Legal Forms Packages of Any Category. How much can you inherit without paying taxes in virginia.

Virginia Ggu Tax Estate Planning Review

Today Virginia no longer has an estate tax or inheritance taxPrior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

. Today Virginia no longer has an estate tax or inheritance taxPrior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. The federal estate tax is due nine months from the date of death and is currently. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

In 2022 estates with a value of 12060000 must file a return a significantly increased upper bound compared to the 1500000 seen in 2004 and 2005. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. Inheritance tax rates differ by the state.

How Much Can You Expect To Pay in Estate or Inheritance Taxes. Your average tax rate is 1198 and your marginal tax rate is. This is great news for Virginia residents.

Virginia Income Tax Calculator 2021. 15 best ways to avoid inheritance tax in 2020. 1- Make a gift to your partner or spouse.

Price at Jenkins Fenstermaker PLLC by. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. 2 Give money to family members and friends.

Because of this the estimated tax totals could be high or low. Unlike the federal government Virginia does not have an estate tax. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

How do you avoid inheritance tax. The top estate tax. Virginia estate tax.

Pennsylvania does charge an inheritance and estate tax in some cases. Federal estate taxes top out at 40 but theres a sizable exemption that prevents most estates from. But just because Virginia does not have.

For Ohio they estimate approximately 220 million with West Virginia at just over 38 million. Generally Virginia does not require an estate tax return unless there is a federal estate tax return due. All Major Categories Covered.

Virginia Estate Tax 581-900. As of 2021 the six states that charge an inheritance tax are. 2 days agoWatch on.

If you dont know what inheritance tax is you probably. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Today Virginia no longer has an estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption threshold. Virginia Inheritance and Gift Tax. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

West Virginia Estate Tax Everything You Need To Know Smartasset

Federal Estate And Missouri Inheritance Taxes Legacy Law Missouri

Virginia Estate Tax Everything You Need To Know Smartasset

Estate Tax Planning In Virginia The Nance Law Firm

The Commonwealth Institute State Tax Proposals Would Make Virginia S Tax

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

States With No Estate Tax Or Inheritance Tax Plan Where You Die

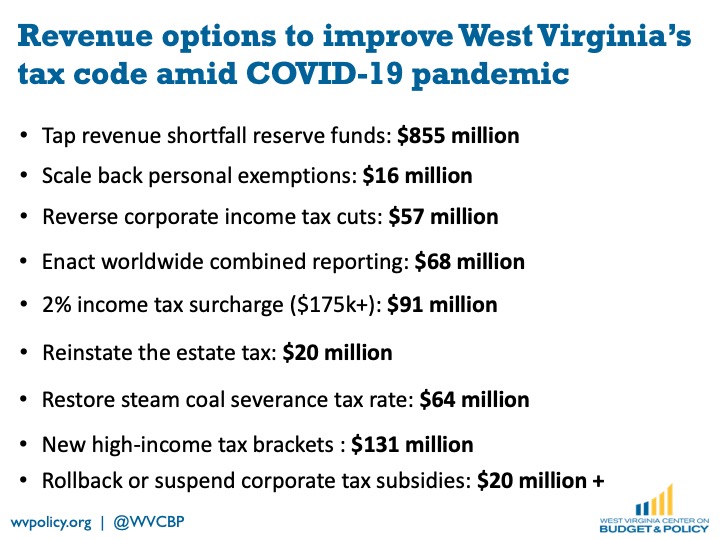

Tap Reserves And Enact Progressive Tax Policy To Address Covid 19 Economic Crisis West Virginia Center On Budget Policy

Severance Taxes Urban Institute

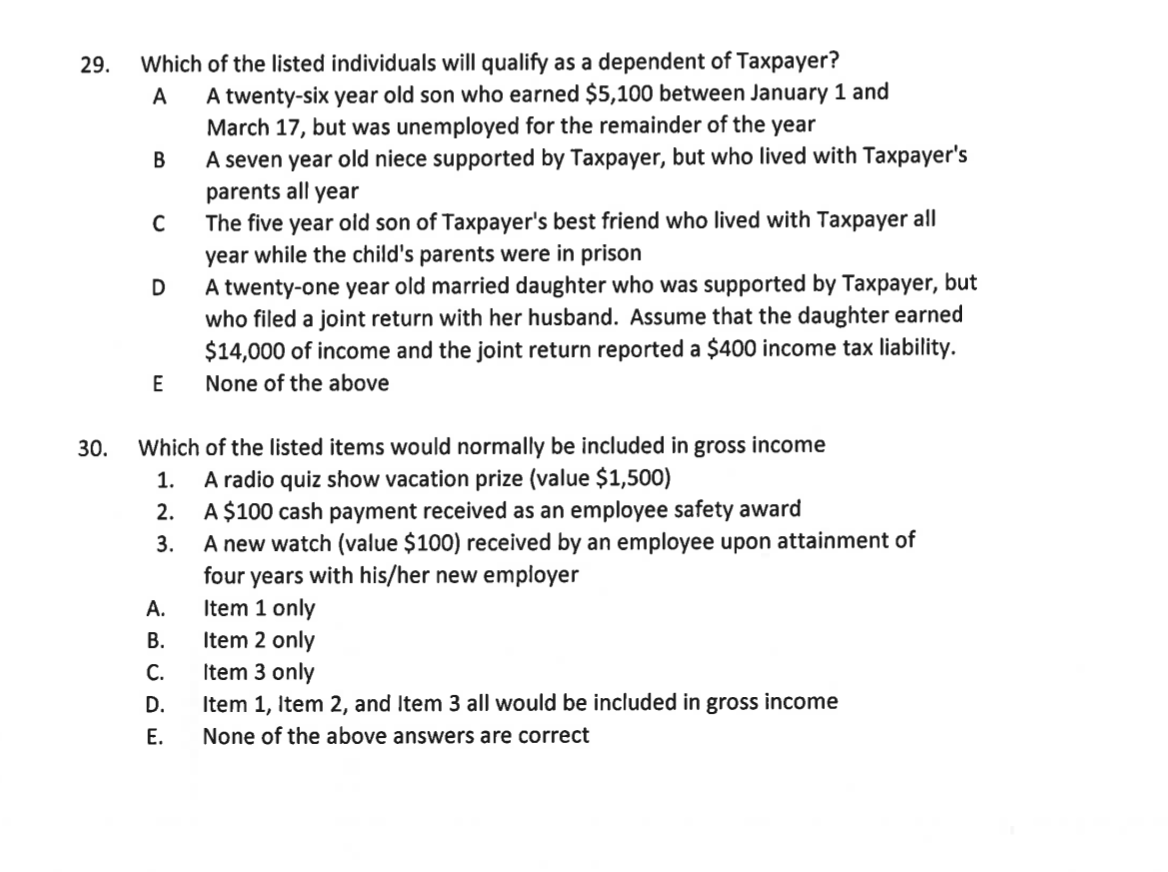

Solved 26 Which If Any Of The Listed Taxes Are Not Chegg Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Health Legal And End Of Life Resources Everplans

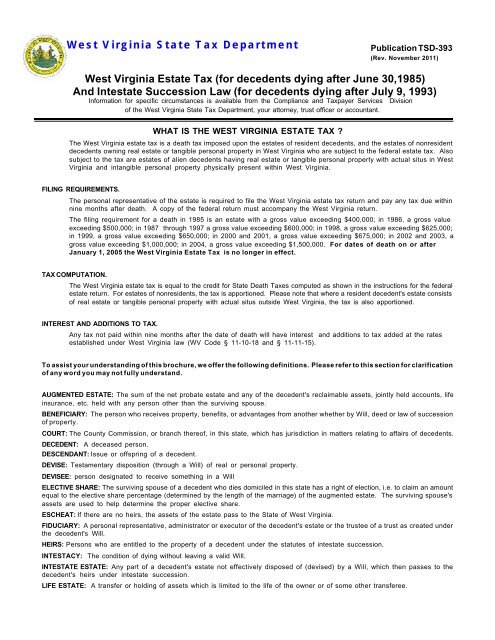

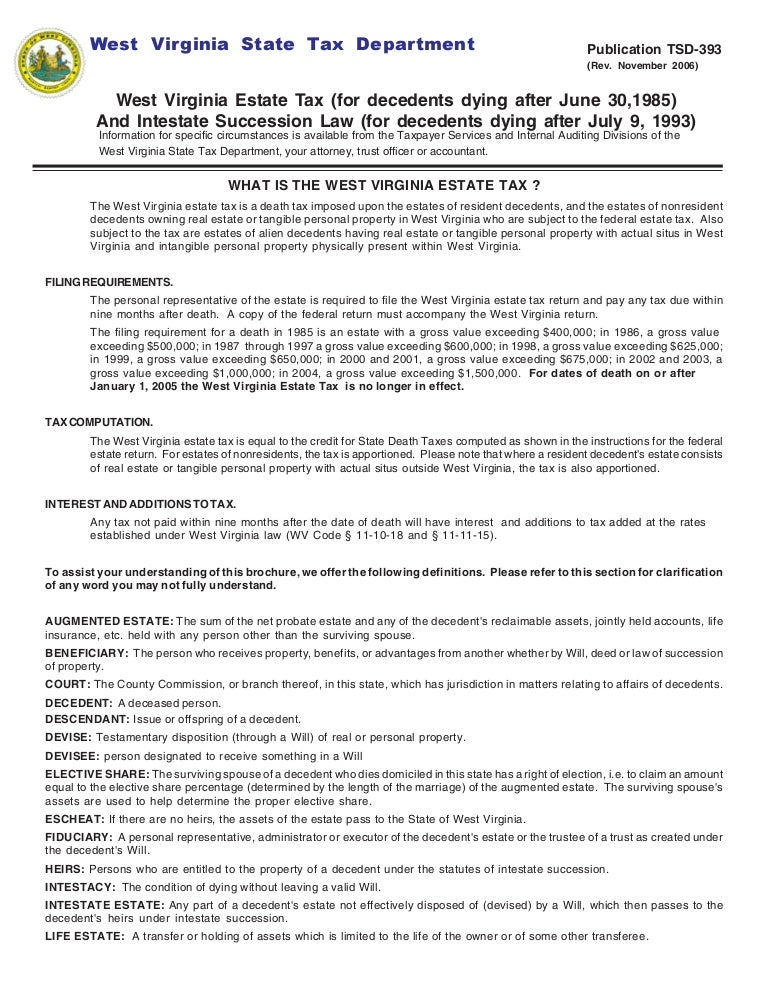

What Is The West Virginia Estate Tax Publication Tsd 393

Estate Tax Calculator Washington Dc Maryland Virginia Lawyer Attorney Law Firm

Estate Taxes Virginia Wills Trusts Estates

Tsd393 State Wv Us Taxrev Taxdoc Tsd

Maryland Raises Estate Tax Exemption Wealth Management